Business View Magazine profiles 3DP printing, as part of our Best Practices in Manufacturing series.

The potential of 3DP printing has captured the popular imagination.

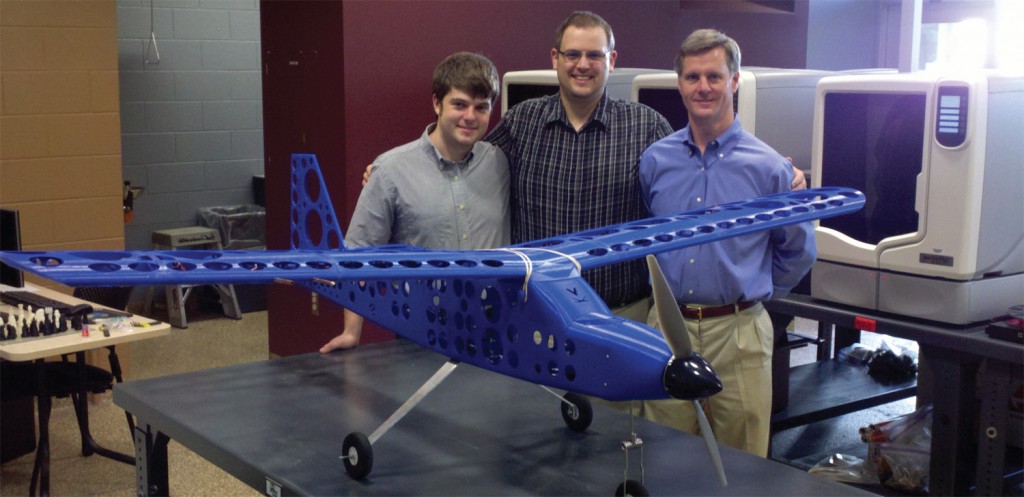

From jet engine parts to made-to-fit bikinis, the technology is being hailed as a revolution in how products are manufactured.

According to estimates, the global 3DP printer market is poised to hit $6 billion by 2017 from $2.2 billion in 2012, with global shipments of printers costing less than $100,000 expected to reach about 98,000 in 2014, roughly twice as many as in 2013. But in the heartland of U.S. industrial manufacturing, 3DP appears more on an evolutionary track as companies large and small shape 3DP programs – and as 3DP printers, software and matDP Printingerials science advance.

What they’re discovering is not just how the technology can build upon traditional manufacturing processes, but perhaps more important, how it can potentially produce products well beyond the scope of traditional manufacturing.

To help get a clearer picture, PwC surveyed more than 100 industrial manufacturers, from small contract manufacturers to multinationals. The overarching story is one of sprinters and sideliners. Two-thirds of manufacturers surveyed are currently implementing 3DP in some way – either experimenting on how to use the technology, or already using it for prototypes or final products. One in four said they plan to adopt 3DP at some time in the future.

Based on this survey, interviews with industry leaders and a PwC analysis surrounding the economics of 3DP, we explored how and why companies are bringing this technology closer to an effectual tipping point of adoption.

There are signs that the technology is on the cusp of being mainstreamed and thus there are glimpses of the disruptions and opportunities that it could create.

Companies investing in the 3DP hardware and the talent to run it are seeing gains in speed and flexibility in research and development, enabling quicker launching of new products and product customization (the “lot of one” model). Early adopters are crossing the critical threshold from tinkerer and prototyper to producers of the final product. Companies are re-imagining supply chains: A world of networked printers where logistics may be more about delivering digital design files – from one continent to printer farms in another – than about containers, ships and cargo planes.

In fact, 70 percent of manufacturers in the PwC Innovations Survey believe that, in the next three to five years, 3DP will be used to produce obsolete parts; 57 percent believe it will be used for after-market parts. Some 30 percent of survey respondents believe that 3DP’s greatest potential disruption will be exerted on supply chains.

Companies are anticipating 3DP-driven savings in materials, labor and transportation costs, when compared to traditional subtractive manufacturing processes. A PwC analysis of 3DP adoption by the global aerospace industry’s MRO (maintenance, repair and operations) parts market, estimates a $3.4 billion annual savings in material and transportation costs alone, assuming a scenario in which half of that industry’s MRO parts are 3DP-manufactured. And, even at a more conservative 20 percent 3DP adoption, savings could easily exceed $1 billion, according to the analysis.

Applying 3DP for rapid prototyping is nothing new for many manufacturers. It enables them (and their suppliers) to sidestep the often laborious, costly and expensive traditional processes – the production of casts, molds and dies, the milling and lathing and other machine work, and finally, the shipping of the object from a supplier (which could be in China). There are signs 3DP can give R&D a redoubled shot in the arm and accelerate new product development cycles which could translate into getting new products to market quicker and more frequently. This is especially the case with prototyping complex parts – or a product that has a system of complex parts. The PwC Innovations Survey found that 25 percent of manufacturers are currently implementing 3DP technology for prototyping only, that 10 percent are using 3DP for both prototyping and the production of final parts; only 1 percent is using the technology expressly for final product production.

As companies wade into 3DP – either through implementing or at least through experimenting and/or assessing a potential application – the technology at present is still limited in the size, strength and complexity of products it can produce, even as it picks up steam as a powerful R&D tool.

Large manufacturers with talent and capital resources already have embedded 3DP into their R&D cultures. General Electric Co., a leader in the technology for two decades, has a global network of 600 engineers involved in 3DP technology. GE, which raised its commitment to the technology through its 2012 acquisition of Morris Technologies, a 3DP specialist, estimates that currently less than 10 percent of its products are “touched” by 3DP (either through prototyping or final production), but that percentage will increase to 50 percent by 2020. Or, take Ford Motor Co., which is taking 3DP’s accelerated prototyping path for parts including brake rotors, rear axles and cylinder heads for its EcoBoost engines. Printing the prototypes (using 3DP binder jetting technology) for the cylinder heads – which have complex configurations including ducts and valves – enables the auto giant to skip the steps of designing a sand mold and a tool to cut castings from those molds.

Ford said the technology saved up to two months. Ford announced at the 2014 North American International Auto Show that it had printed its 500,000th part – a prototype engine cover for its new Mustang model.

It’s often not the part itself where 3DP plays a role, but rather the 3DP-created dies and molds that are printed (for traditional manufacturing, such as injection molding). This yields cost and time benefits, an approach already underway in the aerospace and automotive industries. Increasing potential is seen in 3DP-produced molds for large parts – such as composite panels for automobiles – which could abbreviate the speed-to-market for new automobile models, for example.

AT A GLANCE

WHO: BB&T Center

WHAT: Home of the Florida Panthers

WHERE: Sunrise, Florida

WEBSITE: www.thebbtcenter.com