Kingston Community Credit Union

is long established and making a difference

Putting the community and its members top of its agenda, Kingston Community Credit Union provides the financial lead

The original Kingston Municipal Employees Credit Union in Kingston, Ontario was founded in 1957 by a small group of the city’s workers – police, firefighters, bus drivers, and the like. “At that time, these people, who had steady jobs as municipal employees, did not have ready access to credit, or were not looked well-upon by the big banks,” recalls the credit union’s current CEO, Jon Dessau. “A number of them banded together and contributed a little capital to start a credit union so that they could offer deposits and loans to each other. And it has grown since then.”

In 1974, the modern Kingston Community Credit Union (KCCU) was born when it opened its membership to workers in other industries, and subsequently to the entire Kingston community, truly earning the right to call itself a community-based credit union. “We serve the community as a whole and not just employees at specific workplaces,” Dessau maintains. “When people have deposit needs or credit needs, we’re open to all and have products that should suit all – anyone with means or lack of means. KCCU plays a special role of being there for the ‘underbanked’ who have difficulties in the financial system.”

As a community-based credit union, KCCU is owned by its members and administered by a Board of Directors chosen by and from them. It is based on the principle of maximizing benefit for its membership rather than profit for its stockholders as is the case with the big commercial banks. All of its assets – its employees, its source of deposits, its loans and mortgages, its programs and services, its profits – are all put to work growing the local economy.

Today, KCCU has over $270 Million in assets under administration and 42 employees at three locations in the greater Kingston area. It provides a full range of financial services to its 10,000-plus members, including savings accounts, loans, mortgages, business, and non-profit banking services, as well as online and mobile banking options. “We’re a full-service financial institution, so we really try and cover everything from credit to debt, and provide an alternative to the big banks,” says Dessau. “We don’t do things by formula. When people have deposit needs or credit needs, we take that extra look at their circumstances and factor in things that banks can’t do off the cuff.”

That extra look is what truly personifies KCCU’s operating ethos. Because its members have a say in how the credit union functions, they are always creating new programs and products to suit their needs. “For example, five years ago, we rolled out a wealth office to try and help older members who need to do succession and inheritance planning,” Dessau relates. “We try to have a conversation with each member to make sure that we are finding the truly appropriate product for them. And around Christmas, when people spend a lot, we also have a product where we help them with very short-term credit to make sure they don’t carry a large credit card balance because the last thing we want to do is get people tied into carrying debt beyond what they should be.”

Nowhere is that extra look more important than when KCCU arranges a mortgage loan. Dessau explains: “While it’s not mandated on credit unions to stress-test people when they take out mortgages, we’ve always been doing that because, as a rule, we don’t give a mortgage unless our account managers have that conversation with a borrower and say, ‘Okay. This looks like a great home. This is what the mortgage is going to cost you. But let’s look at where you would be if interest rates went up two-and-a-half percent. We ask whether you are sure you could still carry that mortgage.”

“So, we do a stress test. It’s not mandatory in our industry; it’s a requirement in terms of our lending practices that the members understand and go through that exercise so that they could see where they would be. We’re not helping anybody if we put them in a home they can’t afford,” he elaborates.

When COVID came to Kingston in early 2020, KCCU further aided its mortgage holders, as Dessau recounts: “The immediate impact of COVID was that being a town that relies on students, and tourism in the summer, a lot of people were going to be without jobs in the service industries because the students were sent home and the tourists never came. Immediately in March, within a week, we rolled out a member assistance program and were ready to offer deferrals for loans for anyone who couldn’t meet payments.”

“We helped about a third of our mortgage holders with deferrals. All of them got by without losses or loss of homes or ran into trouble. All of that got rolled up, roughly by the middle of 2022. There was nobody who needed that anymore and they’re all still in their homes and that’s the key thing,” Dessau reflects.

KCCU’s operations go far beyond just serving its members’ financial needs. “We’re not just a business,” Dessau maintains. “Our purpose is also community engagement. It’s part of our mission and part of our strategy and part of the definition of a cooperative. Here at KCCU, it’s the staff who make most of the decisions about who they want to be involved with because there’s no end to needs and you have to pick and choose. But if it doesn’t include something of benefit to the community, it’s not for us. It’s got to have that value proposition.”

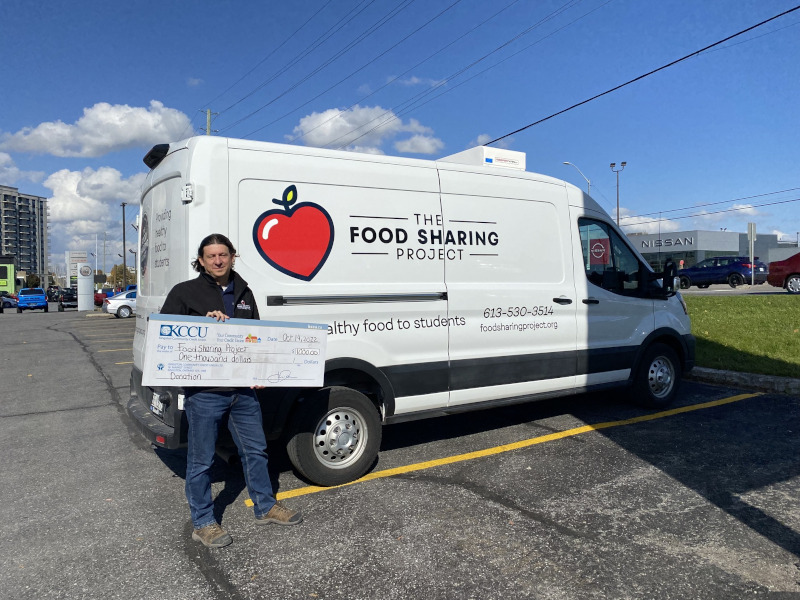

Most recently, a lot of KCCU’s efforts and donations have gone to local women’s shelters and food-sharing projects in the area’s indigenous community. It has also partnered with the City of Kingston’s Community Climate Action Fund. “It’s a fund that seeks donations to help all our cooperatives, non-profits, and charitable agencies in town to do green projects for themselves,”

Dessau says. “You’re busy serving your clients, and you’re busy fundraising, and you have little time to think about your own facilities – your office, your vehicle, your needs. This project is to enable all those organizations to become green themselves – whether it’s their physical infrastructure, the materials they use, or the sources they use for their services. The fund has helped a lot of the charitable organizations in town to become green in their own operations. Climate change is a matter that we have to have on board on the same level as all the other stakeholders: staff, suppliers, members, and the community. The environment is part of our mission.”

Dessau talks about what lies ahead for KCCU.

“One of the things that are always challenging when you’re small is on the one hand, we’re about personal service – we don’t have phone answering machines; we answer the phones ourselves. We always want to show that the member can get through to someone. We have to keep that personal aspect. On the other hand, when you’re in banking and finance, you have to be as good online and digitally advanced as any other financial institution. It means that member security is important, so a lot of the investments we’re making, you don’t see in the front end but they’re necessary, like cyber security. It’s not cheap but you’ve got to do it right.”

“The focus for 2023 and for the next three, or four years is to honor our digital offerings while ensuring that we retain that loop back to the personal. Marrying those two aspects is what we’re focused on.”

Dessau adds that the credit unions’ focus will be to expand its small business capabilities and will be introducing a new package of accounts and online features for small businesses over the next two years.

“We want to make sure that small businesses are aware of all the support they could have. That is another niche where the personal touch is really important and where credit unions have great success because, often, people fall through the cracks at bigger banks. That’s something I’m looking forward to. We’ve been planning this for quite a while. We’ll be rolling it out to members over the next couple of years.”

As Jon Dessau approaches his tenth anniversary as the Kingston Community Credit Union’s CEO, he expresses abiding enthusiasm over the institution’s character and mission and sees no reason to change course.

He says in conclusion, “I get up, knowing that the business we have is not just selling a product. The members own it. It’s their credit union; they have real ownership. And we make a difference; it’s actually palpable. That’s what we’ve tried to create.”

AT A GLANCE

Kingston Community Credit Union

What: Community-based credit union with deep roots in the area and a dedication to its members

Where: Kingston, Ontario

Website: https://www.kccu.ca/