New York Credit Union Association

the advocacy and educational voice for the credit union sector

With the needs of its members top of mind, the New York Credit Union Association paves the way for credit unions in New York state.

The Association abides by four core propositions to advance the credit union movement — advocating, educating, uniting, and supporting the interests of all credit unions and their members in the state of New York.

The Association represents approximately 295 credit unions, which are different in structure from banks. Credit unions are chartered to serve their members’ financial needs and aim to empower and assist their communities in succeeding by focusing on financial strength, stability, awareness, and health.

This is achieved by driving people to better financial services by providing them with the best education on fiscal matters and allowing better access to affordable financial products.

Structurally, banks are responsible to shareholders, stockholders, or other third-party backers, while credit unions are only responsible to their own members.

“We have nothing against banks. But we are accountable to only our members as a not-for-profit, tax-exempt entity. That means we can focus on being more involved in educating our members on how to manage their finances,” says William J. Mellin, President and CEO of the New York Credit Union Association.

William Mellin: William J. Mellin, President/CEO of the New York Credit Union Association.

The Association has several key and notable initiatives. Regarding advocacy, the Association focuses on the legislative side, whether it is working with the state legislature , governor’s office, congressional delegation, or senators representing the state of New York in the U.S. Congress.

When consulting with these various levels of government, the Association’s role is to ensure that the legislators they’re liaising with are educated about why credit unions are tax-exempt and understand their mission and purpose.

“We inform these individuals about the services we bring and how we bring them to our members and their constituents in the state of New York,” says Mellin.

Under the advocacy umbrella, the Association will also drill down and educate these government officials about how pending and introduced bills in Congress or the New York State Legislature will impact credit unions, whether positively or negatively.

While most legislation is drafted with the best intentions, some can result in unforeseen outcomes. Only through education can these legislators and elected leaders understand the side effects.

“There are a lot of bills introduced that impact financial services, and we review how they’ll impact credit unions. This means on the legislative and regulatory side, our organization works with the Department of Financial Services, for example, to ensure they understand our view about different regulations,” says Mellin.

Regarding consumer advocacy, the Association ensures potential members understand the differences between credit unions and banks, as well as the benefits and opportunities provided by credit unions.

While the number of credit unions is becoming smaller ,the reason for the decline could be attributed to several reasons.

“Whether it is a lack of ability to recruit exemplary leadership, or that the board of directors chooses to merge together, this is an issue for the New York Credit Union Association as fewer credit unions mean lower membership numbers,” says Mellin.

Another industry issue that the Association has earmarked are increases in credit union service fees and how to best deal with serving members. For almost all financial institutions, service fees are the predominant revenue stream.

“I think credit unions are always wrestling with this balancing act. How do we not ’fee‘ our members to death, but at the same time, how does the institution remain solvent and strong for our members in a low-interest rate environment – and I know this is a discussion point at the board level,” says Mellin.

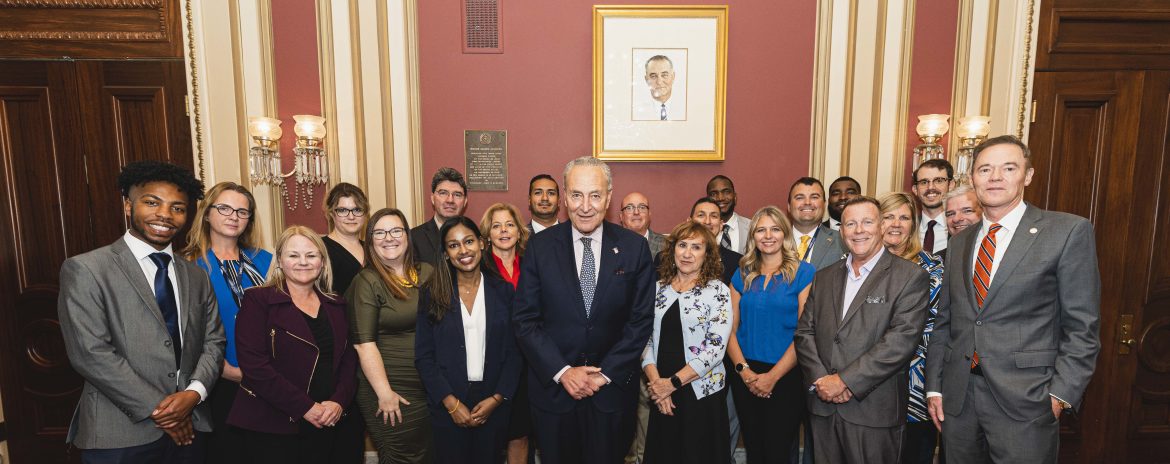

To address and alleviate these concerns, the Association recently visited Washington, D.C. with a large delegation during the CUNA Governmental Affairs Conference. Before attending any meetings with legislators, the delegation team ensures that they are up to date with all bills that may impact credit unions.

Mellin with NY Gov Hochul: William J. Mellin, New York Credit Union Association president/CEO, met one on one with Gov. Kathy Hochul at an event in Saratoga Springs, N.Y.

The Association also ensures that member credit unions are ready to meet with their legislators to remind them of the excellent work that credit unions do on a day-to-day basis.

After attending this conference, the Association focused on its state-level governmental affairs conference. Part of the planning for this event involved getting members engaged and becoming more politically active.

This also includes ensuring that they attend fundraisers, programs, and events for state legislators. The Association frequently has the opportunity to meet with the governor, representatives from the Department of Financial Services, as well as elected leaders to share the excellent work that credit unions are doing.

The Association understands it is involved in a movement to help the people who use credit union services and its role is to also educate CEOs, boards of directors, as well as credit union employees in New York state about the important impact credit unions make. have.The Association continually ensures that they remind credit unions of their philosophy.

“One of our missions is reminding employees of credit unions that they are not working a 9-to-5 job. They’re actually coming in every day to help the credit union carry out its mission, helping consumers live better lives. And we believe in this philosophy,” says Mellin.

Also, the Association facilitates its members’ education on new rules and regulations, such as overdraft fees, bankruptcy, and foreclosure laws.

2022 Annual Meeting: Attendees at EXCEL 22, the New York Credit Union Association’s Annual Meeting and Convention, gather for a group photo at the Sagamore Resort on Lake George in Bolton Landing, N.Y.

Another service that the Association offers to its members is shared branching operations via UsNet. The shared branching operations service allows credit union members to join and network amongst themselves. This permits members from different credit unions to conduct financial transactions together in networked outlets across state lines.

OwnersChoice Funding is another affiliate of the Association, a large mortgage company that allows credit unions to offer competitive and affordable mortgages to their members. OwnersChoice is also member owned and operates in 16 states as far as licensing is concerned.

An additional primary partner of the Association is TruStage (formerly CUNA Mutual Group). The leading service that TruStage brings to the table is insurance products and technology for credit unions.

The Association also circulates a newsletter called the New York Minute. This is an informative email created to notify members of important credit union news. These emails are also posted on the Association’s website, which members are encouraged to visit.

In addition, the Association utilizes social media channels to engage its members. And this kind of connection with members is key.

“We can’t be here without the support from our members. There’s no strong political action committee without them. So, whatever we do as an Association, we look to engage our members,” says Mellin.

In terms of creating visible communication, the Association helps its members to be seen within their own communities. One example is an event that the Association organized with Habitat for Humanity in 2022, where members helped build a home for a family in need. Credit union support came from far and wide to assist, from Long Island all the way to Niagara Falls, Buffalo, and Watertown. This event highlighted the issue of the housing crisis which encompasses affordability and actual physical housing shortages. It’s events like these that spark conversations about what financial institutions can do to address this issue.

As an Association, the members are passionate about the movement they are involved with. Mellin concludes.

“It’s about coming to work every day and thinking that you can make a difference in the lives of people in a positive way. You can help credit unions instill their philosophy and remind them of who we are. We don’t have a job; we have a mission and purpose. I love what we do.”

AT A GLANCE

New York State Credit Union Association

What: The organization that represents the needs of state-based credit unions through advocacy and educational initiatives

Where: Albany, New York

Website: https://nycua.org/