Georgia Community Bank (GCB)

Banking on Community: GCB’s Journey to Empower Local Economies and Foster Financial Inclusion

Discover how Georgia Community Bank (GCB) is revolutionizing community banking in Southwest Georgia, from innovative technology to impactful community initiatives and its strategic vision for a prosperous future.

In the heart of Southwest Georgia, Georgia Community Bank is a lifeline for the small, often rural communities it serves. The bank’s presence is felt not only through its financial services but also through its role as a significant employer and supporter of local charities. With a rich history dating back to 1922, when The Citizens State Bank opened its doors in downtown Reynolds, Georgia, GCB has grown and evolved to serve communities across Southwest Georgia. Today, GCB operates in multiple counties, including Terrell, Lee, Dougherty, Seminole, Early, Taylor, and Crawford, staying true to the community-oriented principles upon which it was founded.

GCB is more than just a bank; it is a community pillar supporting local businesses and individuals. The bank’s products and services are designed to meet the unique needs of its customers, from online and mobile banking to a range of loan and deposit products. GCB’s team of experienced bankers is committed to providing exceptional customer service, ensuring each customer feels valued and supported.

Lucie Beeley, CEO and Chairman of the Board of Directors, passionately describes GCB as an actual community bank. “We are not only supportive in that we donate to local charities, we’re also a major employer in some of these communities,” she explains. “I feel as though some of the areas in which we have branches that we certainly help propel the communities economically.”

GCB’s headquarters are in Albany, Georgia, with its largest bank branch in Dawson, Georgia. These locations, while integral to their communities, are pretty removed from the bustling city of Atlanta. “Our most populated area, Albany, is still about two hours and 45 minutes away from Atlanta,” Beeley notes.

This geographical distance from the metropolitan hub of Atlanta is by design, as GCB’s primary focus is on serving consumers, small businesses, and agriculture in smaller communities. “I certainly would not say that someone in the Atlanta market would be our primary target,” Beeley clarifies. “Most of our customer base is not what financial institutions in the Atlanta market targets.”

GCB’s commitment to its communities is evident in its tailored approach to banking, ensuring that the unique needs of its customers are met with personalized, community-focused services. The bank’s team of experienced bankers works diligently to provide exceptional customer service, solidifying GCB’s reputation as a trusted partner for businesses and individuals.

Community Engagement and Economic Support

Community Engagement and Economic Support

Georgia Community Bank is deeply intertwined with the communities it serves, actively participating in initiatives that directly benefit local institutions and residents. This symbiotic relationship is a cornerstone of GCB’s operations, reflecting its commitment to fostering the growth and prosperity of the communities it calls home.

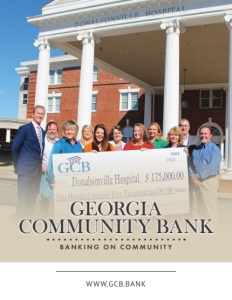

Beeley shares a recent initiative that exemplifies GCB’s community involvement. “We recently donated, through the Georgia Heart program, $175,000 to a rural hospital in Donalsonville, Georgia,” she says. This significant donation, presented by Chief Operating Officer Heidi Breeden, is a clear demonstration of GCB’s dedication to supporting essential local services.

In addition to its community support, GCB is also proactive in adapting its banking services to meet the evolving needs of its customers, especially in the face of economic challenges such as inflation. “We have tried very diligently to develop unique lending solutions,” Beeley explains. “We have extended our terms further than we normally would, even though the interest rates are higher, we are trying to keep people’s payments the same.” This approach, extending loan maturities and terms, exemplifies GCB’s commitment to providing flexible and accommodating financial solutions to help its customers navigate challenging economic times.

Supporting Local Initiatives and Education

GCB’s commitment to community support extends beyond financial services, actively participating in local initiatives and educational programs that benefit residents and foster a sense of community.

Beeley takes pride in GCB’s support for essential charities to its employees. “If our employees are involved with a particular charity, we try to make sure that we support those charities,” she says. This is evident in GCB’s involvement with the Anchorage, a drug and alcohol rehabilitation center in Albany, Georgia.

Breeden, who is passionate about Anchorage, shares how GCB has not only provided financial support but also initiated educational programs at the center. “We have started teaching a basics of budgeting and financial literacy class out there,” she explains. The classes, which include engaging activities like banking bingo and a planned pickleball tournament, are part of GCB’s efforts to provide practical support to those in recovery.

In addition to supporting local initiatives, GCB is committed to financial education in schools. Beeley explains that GCB sponsors financial literacy training for high school and elementary students through a Banzai program. “If it’s a school in an area that we service, we 100% pay for that sponsorship,” she says. Currently, GCB sponsors nine schools through this program.

Furthermore, GCB is actively involved in providing financial education in local schools. “Just last week, we had two teachers reach out from Terrell Academy, a private school in Dawson, asking if we would be willing to talk to their 10th, 11th, and 12th graders,” Breeden shares. This proactive approach to financial education reflects GCB’s commitment to empowering the next generation with the knowledge and skills they need to make informed financial decisions.

Adapting to the Times While Preserving Core Values

Over the past century, GCB has evolved to meet the changing needs of its communities while preserving the core values that have defined its operations since its inception in 1922.

Beeley reflects on the bank’s history and commitment to serving the community. “The foundations on which the bank was established are the same, it is to service our communities, and that will never change,” she says. “How we have done this over time has evolved with technology.” This evolution includes investing in technology to compete with larger banks and meet the expectations of younger generations.

In addition to embracing technology, GCB strives to maintain a personal touch in its customer service. “When you need to talk to somebody, the last thing you want is to be limited to emailing someone or go through an automated phone service,” Beeley explains. “We pride ourselves on always picking up the phone and being proactive if we see a problem with a customer’s account.”

This commitment to customer service, combined with efficient and thorough underwriting practices, sets GCB apart from larger banks. “We can do it efficiently and much more quickly than a larger bank can,” Beeley says. This efficiency extends to the bank’s flexibility in offering loans and other services, especially in rural communities where residents may not meet the eligibility requirements of larger banks. “I believe we can be more flexible,” Beeley concludes. “We probably bank people in some of these rural communities that I do not believe would meet the eligibility requirements of a large financial institution.”

Employee Appreciation Day

Embracing Digital Transformation

The digital landscape has revolutionized the banking industry. GCB has adeptly navigated this transformation, ensuring its customers can access a suite of online options that provide convenience and security.

Breeden outlines the bank’s online offerings, “Through our online banking, you can pretty much do anything. You can make payments to your loan, and we have a mobile deposit so you can deposit your checks without ever even coming to the bank.” This digital shift proved invaluable during the COVID-19 pandemic when GCB utilized its online platforms and drive-thru services to continue serving its customers while adhering to safety protocols. “We would meet people in the parking lot if needed,” Breeden adds.

In addition to its existing online services, GCB is implementing positive pay, a feature designed to combat check fraud for commercial customers. “They can review each check and ACH that comes through. If it’s fraud or unauthorized, they can mark it for return,” explains Breeden.

Beeley highlights other innovative programs GCB offers, including Zelle, a person-to-person payment solution, and digital wallets. “Our debit cards are now supported with Samsung Pay, Google Pay, and Apple Pay,” says Breeden. This recent addition has been well-received by customers, providing them with a convenient and secure payment option that aligns with the modern preference for using debit cards over credit cards.

Expanding Horizons and Nurturing Growth

As GCB continues to thrive and evolve, the bank is actively exploring new avenues to extend its reach and enhance its services. Beeley shares exciting developments on the horizon, “By the end of the year, we are leasing space in Warner Robins, Georgia, to open a loan production office. Eventually, we aim to transform this into a full-service branch.” This strategic expansion aligns with GCB’s commitment to serving communities and fostering economic growth in the region.

In addition to its physical expansion, GCB is also focused on bolstering its workforce and ensuring the well-being of its employees. “We do not experience high turnover, and our retention rate is commendable,” Beeley proudly states. The bank offers a comprehensive benefits package, including fully paid insurance, disability coverage, paid vacation, and sick days. Moreover, GCB invests in its employees’ future by contributing to a Sep IRA at no cost to the employee, further solidifying its commitment to its workforce. The bank also owns two condominiums in Mexico Beach, Florida that are strictly for employee and their families’ use during their vacation time. The bank also recently hosted its first annual Employee Appreciation Day, held at a local venue where employees could spend the day with their families and co-workers and enjoy food, beverages, and a variety of entertainment, also paid for by the bank.

Looking ahead, both Beeley and Breeden share their vision for the future. “Our top priority is ensuring the success of the Warner Robins loan production office and expanding our deposit base,” Beeley emphasizes. Additionally, GCB aims to fully integrate its interactive banking terminals with its core system by 2024, providing customers with the convenience of self-service banking kiosks. “This will allow customers to bank with us even on weekends, without needing physical presence,” Beeley concludes, highlighting GCB’s dedication to customer convenience and satisfaction.

AT A GLANCE

Georgia Community Bank (GCB)

What: A community bank dedicated to serving local communities, small businesses, and agriculture in Southwest Georgia, focusing on personal touch and innovative banking solutions.

Where: Headquartered in Albany, Georgia, with branches in Southwest Georgia, including the largest bank branch in Dawson, Georgia.

Website: https://gcb.bank/