Are you looking for a way to get your business growing again? Perhaps you have been turned down for a loan, or don’t want to take on more debt. If this is the case, invoice financing may be the answer for you. Invoice financing is a type of short-term lending that can help businesses grow by allowing them to turn their unpaid invoices into cash.

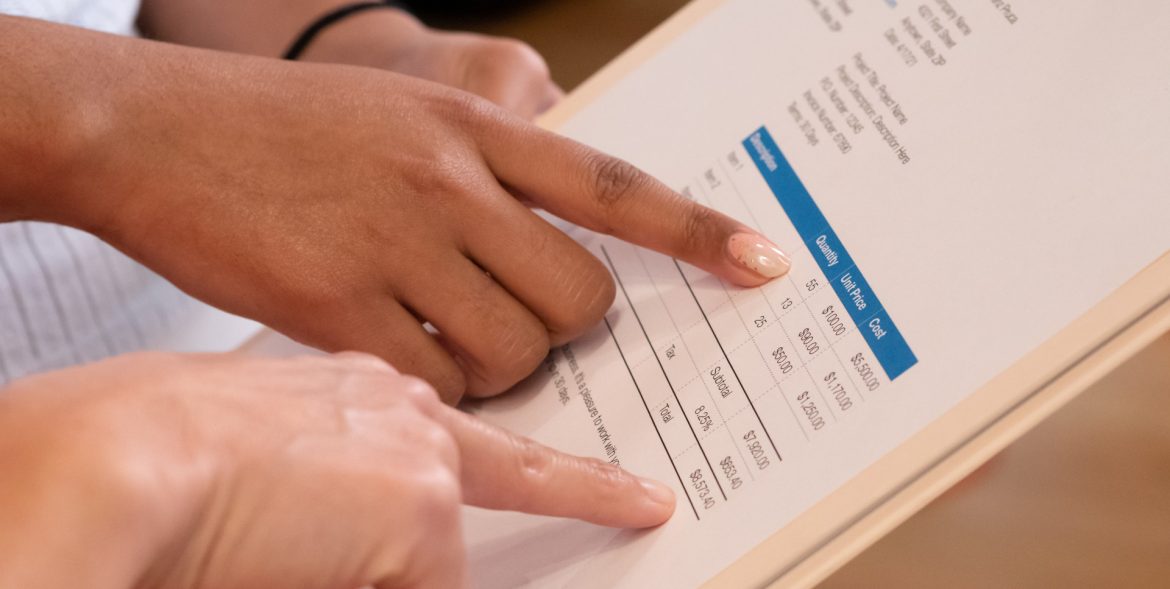

What is invoice finance and how does it work

Invoice finance is a type of funding that allows businesses to receive cash upfront for their outstanding invoices. This can be a valuable source of working capital, as it allows businesses to access the funds they are owed immediately, rather than waiting for their customers to pay.

How invoice finance works is relatively simple. The business contacts an invoice financier and provides them with details of the invoices they wish to finance. The financier then pays the business an agreed percentage of the value of the invoices upfront, Less any fees charged by the financier. Once the customer pays the invoice in full, minus any discounts or early payment terms included in the finance agreement, the remaining balance is paid over to the business by the financier.

Invoice finance can be a flexible solution as businesses can choose to finance selected invoices or all of them, and they are not usually tied in to long-term contracts. The amount of funding available also tends to increase as a business grows and raises more invoices.

The benefits of invoice finance for small businesses

Invoice financing is a great way for small businesses to improve their cash flow. When a business sells a product or service, it often takes time for the customer to pay their invoice. This can leave the business with a shortage of cash, which can be difficult to manage.

Invoice finance allows businesses to borrow money against the value of their unpaid invoices. This gives the business access to quick and easy financing, which can be used to cover expenses like payroll, rent, and supplies. Invoice finance also helps businesses avoid late payment penalties and interest charges.

The different types of invoice finance available to businesses and what each one offers

There are three types of invoice finance: factoring, discounting, and invoice buying. Factoring involves a business selling its accounts receivable (invoices) to a third party, called a factor. The factor then pays the business upfront for the invoices, minus a fee, and collects the money from the customers who owe the business money. Discounting is similar to factoring, but with one important difference: the factor buys the invoices at a discount rather than paying the full amount upfront. Invoice buying is when a company pays for an invoice immediately and then collects it from the customer itself.

Each type of invoice finance has its own set of benefits and drawbacks. For example, factoring is a great option for businesses that need quick access to cash but it can be expensive. Invoice buying is a good option for businesses that have the time to wait for their invoices to be paid but might not have the resources to collect payments from customers themselves. Discounting is a type of invoice finance that can be beneficial for business owners who have good credit but might not have the collateral to qualify for a loan.

Tips for using invoice finance to grow your business

Invoice finance is a great way to grow your business. Here are some tips for using it to its fullest potential:

- Make sure you have a good relationship with your supplier. The last thing you want is to have them hold up payments because they’re not happy with the arrangement.

- Keep track of your invoices carefully and make sure you submit them on time. This will help avoid any penalties or fees.

- Make sure the terms of the invoice finance agreement are clear and concise, so there are no surprises down the road.

- Stay on top of your finances and keep track of how much money you’re spending and earning. This will help you stay in control of your business and avoid any financial problems.

The risks associated with invoice finance

Invoice finance can be a risky proposition for businesses, as it can leave them vulnerable to non-payment.

When a business takes out an invoice finance facility, it is essentially borrowing money against the value of its unpaid invoices. If a customer does not pay their invoice, the business may be left liable for the amount owed. This can put the business in a difficult financial position and may even lead to it going bankrupt. For this reason, it is important for businesses to carefully consider whether invoice finance is right for them and to make sure they have a solid repayment plan in place.

Written by Henry Hols from ScotPac, Sydney, Australia: https://www.scotpac.com.au/