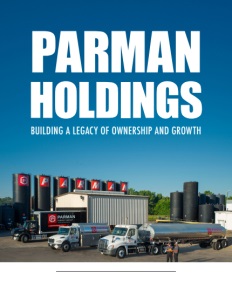

Parman Holdings Corporation

Building a Legacy of Ownership and Growth

Leveraging employee ownership and strategic acquisitions to foster innovation, preserve legacy, and drive sustained growth in a rapidly evolving market.

Parman Holdings Corporation operates under a uniquely diverse business model. As CEO Rachel Hockenberger explains, the corporation currently operates across multiple industries. “Our parent company is Parman Holdings Corporation, and we have two operating entities,” she states.

These include Parman Energy Group, a petroleum distribution company with a legacy spanning nearly 90 years, and Parman Tractor and Equipment, which deals in agricultural and construction equipment. “The parent company holds the ESOP, the employee ownership platform,” she notes, emphasizing the innovative structure designed to enhance employee engagement and value.

When discussing the recent trends and challenges faced by Parman Holdings, Hockenberger highlights the significant impact of their diversification strategy. “We diversified six years ago, just as we were reaching the Covid stage of life,” she recalls. This move introduced them to a new industry they were initially unfamiliar with.

Yet, the employee-owned nature of the company cultivated a deep-seated commitment to overcoming obstacles and finding customer-centric solutions. “You want to make it work and find a solution for the customer,” Hockenberger emphasizes, reflecting on the company’s approach during the pandemic. They adopted a mindset of providing alternatives rather than outright refusals, which proved crucial during supply chain disruptions and other COVID-related challenges.

Hockenberger also elaborates on the company’s approach to client relationships, contrasting the typical transactional interactions in retail. “We are very much a relationship company,” she asserts. Parman Holdings aims to establish long-term relationships with its customers, ensuring they return for continued service and new purchases and, ideally, recommend the company to others.

“Our goal is to create a relationship with our customers so that they are repeatedly returning for continued service on machines, or their next machine, or for their petroleum products,” she explains. This relationship-focused strategy enhances customer loyalty and builds a strong reputation in the marketplace.

The Human Touch in Business Operations

Parman Holdings prides itself on a unique client approach that evokes long-term relationships rather than mere transactions. This relationship-centric ethos extends beyond the customer base and permeates the company’s internal structure, shaping how leadership interacts with employees and how employees engage with their roles.

CEO Hockenberger reflects on the shift in transparency that accompanied the transition to an employee-owned model. “Years ago, before becoming employee-owned, transparency was not a thing. You don’t want to go to your employees, suppliers, or customers and say, cash is tight.” This era of openness has transformed how the company communicates internally and externally. Parman Holdings ensures a mutual understanding that encourages cooperation and problem-solving by sharing pertinent economic challenges and encouraging customer honesty.

The ESOP model brings numerous employee benefits, extending beyond financial gains. “The biggest compliment for us is to look at drivers or technicians who have been with us for years and know that we’ve set aside this amount of cash every year based on our performance,” says Hockenberger. This wealth creation tool is designed to support employees well into retirement, providing a tangible reward for their hard work and dedication. It’s a holistic approach that offers a paycheck and promises long-term financial security and legacy-building opportunities.

Hockenberger elaborates on the broader benefits of the ESOP model, particularly the sense of autonomy and ownership it instills in employees. “You see ownership come to life when people act like an owner. They take the lead, investigate situations, and bring solutions.” This culture of ownership promotes proactive behavior and a deep sense of responsibility, significantly enhancing the overall working environment.

Central to Parman Holdings’ success is the company’s focus on cultivating a positive company culture. “A major priority for us is culture and ensuring that employees, especially newer ones who are not yet vested, come into the office daily with the right mindset,” Hockenberger notes. They have replaced the traditional review process with a coaching culture, promoting continuous development and clear communication of objectives and goals. This supportive atmosphere encourages employees to grow, make decisions, and feel empowered in their roles, making it a place where people want to work rather than just a place they have to be.

Creating a Culture of Ownership

At Parman Holdings, the hiring process is meticulously designed to ensure that every candidate is evaluated with the same rigor and importance, aligning with the company’s employee-owned philosophy. CEO Hockenberger attributes this robust system to their Chief Human Resource Officer, Julie Pomeroy, and her team.

“They implemented a rigorous process on hiring, making sure that we were vetting all candidates through the same process,” she explains. This approach treats every potential hire as a future owner, emphasizing the significance of their role from the outset.

Nevertheless, Hockenberger acknowledges the challenge of communicating the long-term benefits of employee ownership to younger recruits who might not prioritize retirement savings. “We do encounter a lot of younger individuals whose main focus may not be that wealth generation tool because they’re thinking of the dollars and cents they’ll bring home on Friday,” she notes.

However, Pomeroy’s team effectively conveys the value of the ESOP model, highlighting how employees can be fully vested within six years. This initial conversation helps new hires understand the financial benefits and the cultural advantages of being part of a team that takes pride in their work.

When discussing the broader advantages of the ESOP model, Hockenberger points to the importance of long-term planning. “A big advantage is carrying the legacy story forward,” she asserts. This is particularly relevant for multi-generational businesses without a clear succession plan. By transitioning to an employee-owned organization, these companies can maintain their quality and retain long-term staff while providing them with the wealth generation benefits of ownership.

Hockenberger believes that employee ownership creates a unique level of care and dedication. “I think there’s a level of care that an employee ownership organization brings that you may not get with just a private financial buyer,” she says. This care translates into a more robust, cohesive culture where employees are deeply invested in the company’s success and enduring legacy.

Expanding Horizons and Sustaining Growth

Parman Holdings continues to build on its foundation with strategic revenue growth and capital infrastructure initiatives. CEO Hockenberger sheds light on the complexities and rewards of the employee ownership model.

“The employee ownership model is not for the faint of heart because there is a lot of work that goes into it,” she admits. Significant expenses are associated with maintaining this structure, including costs for third-party counsel, trust management, and auditing. These are expenses a privately owned company might avoid.

However, she believes that the dedication and innovation of employee-owners more than compensate for these costs. “We’ve done so much more here with fewer people involved because the people, who are owners, really want to work so much harder, and they bring ideas to the table,” she says. This drive and commitment have been instrumental in Parman Holdings’ success, now in its ninth year of employee ownership.

Looking ahead, the company is on the verge of a significant milestone. “Next year is our 10th year. Through this process, we’ve relieved some of the original ESOP debt we took nine years ago,” Hockenberger explains. With a significant portion of this debt set to be cleared by the ten-year mark, Parman Holdings is poised to pursue further diversification.

The company’s strategy for growth involves adding new operating companies to its portfolio. “Our goal is to continue to diversify. We want to add another operating company to stand alongside Parman Energy Group and Parman Tractor and Equipment,” she reveals. By expanding the portfolio, Parman Holdings aims to enhance share value and provide additional revenue streams for its employee-owners while spreading the risks associated with industry-specific and seasonal fluctuations.

This growth strategy isn’t just forward-looking; it also builds on a solid foundation of recent successes. “Since the ESOP took root in the company, we’ve had major revenue and gross profit growth,” Hockenberger highlights. Despite navigating some of the most challenging seasons in the company’s history, it has survived and thrived, demonstrating the resilience and effectiveness of the employee-owned model.

Future Focus: Strategic Growth and Integration

As Parman Holdings works through the current business climate, its strategic vision remains firmly set on growth and expansion. CEO Hockenberger highlights the roadmap for the next 18 months.

“We’re in our year 2024, and we just have gone through two acquisitions,” she begins, acknowledging the immediate task. The company is in the cleanup phase, ensuring these new entities run smoothly and align with Parman Holdings’ operational standards.

This integration period is critical as it lays the groundwork for future acquisitions. “We are continuing to look for strategic acquisitions to roll into the operating companies,” she states. This proactive approach reflects the company’s ambition to expand its footprint and diversify its portfolio further. By carefully selecting industries that complement its core businesses, Parman Holdings aims to enhance its market position and create additional value for its employee-owners.

Members of the executive team are evaluating potential sectors that align with the company’s business philosophy. “It’s the executive team and myself looking at what industries would complement our current core businesses,” Hockenberger explains. This thoughtful consideration ensures that any new acquisition can integrate and contribute to the company’s long-term goals. They are mainly focused on partnering with companies that wish to preserve their legacy while ensuring the well-being of their employees.

Hockenberger emphasizes the human element in their acquisition strategy. “We would consider a company that wants to pass along some of their legacy and have their people cared for into the future,” she says. This approach not only facilitates smooth transitions but also honors the histories and cultures of the acquired companies. It reinforces Parman Holdings’ reputation as a company that values people and legacy as much as profit.

As Parman Holdings moves forward, its dual focus on integration and strategic acquisition will shape its trajectory. With a solid foundation, a clear vision, and a dedicated team, it is well-positioned to continue its impressive growth and ensure a prosperous future for its employee-owners and the broader community it serves.

AT A GLANCE

Parman Holdings Corporation

WHAT: Employee-owned company specializing in petroleum distribution, utility rerouting and construction & ag equipment

WHERE: Headquarters in Nashville, TN