Four Generations of Banking

A Dynamic Bank Built on Handshakes and Hometown Trust

In the heart of Kansas, where rolling prairies meet small-town values, Central National Bank has been serving communities since 1884. What began as a single branch in Junction City has grown into one of the state’s strongest financial institutions, now operating 35 branches across Kansas and Nebraska with $1.27 billion in assets. Yet despite ranking among the largest banks in the state, Central National has maintained something increasingly rare in modern banking: genuine local control and family stewardship spanning more than a century.

“My great grandfather joined Central National Bank in 1914,” says Sara Girard, Chief Executive Officer of Central National Bank. “It’s extended from 1914 to today, 2025. Over a hundred and ten years now.” Girard represents the fourth generation of her family to work at the bank, alongside her brother who serves as Chief Risk Officer and General Counsel. Her two uncles remain active in the business, while her father served as bank president for 45 years in Junction City, the bank’s longtime headquarters.

The transition to Girard’s leadership was a notable shift in tradition. “Before me, it had been Edward W. Rolfs, my great grandfather, Edward J. Rolfs, my grandfather, and Edward C. Rolfs, my uncle,” she explains. “My first hurdle in my new job was my name, as the leader of the bank had been Edward Rolfs for over 100 years.” The bank now serves 22 communities across Kansas, with Girard’s office located in Topeka, signifying the institution’s expansion while maintaining its foundational focus on community banking principles established generations ago.

Keeping Local Leadership at the Core

Central National operates across two dozen communities, yet each branch functions with remarkable autonomy. Local bank presidents act as entrepreneurs within their markets, making lending decisions and community investments without layers of corporate approval. “Keeping our local community bank feel is absolutely critical to our bank success,” Girard says. “We really strive to make sure each of our community bankers, our presidents and our field managers in their own community knows that they’re empowered to make their decisions.”

The model originated with Girard’s grandfather, who believed strongly in decentralizing authority. “He felt it was really important to let each local bank president be their own entrepreneur and grow their presence,” she notes. This approach bucks the consolidation trend reshaping American banking, where community banks have steadily declined in number while mega-banks absorb market share. Federal Reserve data shows community banks remain the predominant banking providers in rural areas, yet their national presence continues shrinking under competitive pressure.

Central National’s size provides advantages without sacrificing personal relationships. The bank offers sophisticated technology platforms and lending capacity that smaller institutions struggle to match, yet customers still interact with bankers who live in their towns. “We really want to make sure all of our customers know that they have a handshake and a friendly face that they know right in their hometown that they can do business with,” Girard explains. “And we keep that model everywhere we go.” Branch managers lead through corporate citizenship, serving on local boards and volunteering in schools, creating ties that transcend typical business transactions.

Banking Where the People Are

Central National has reimagined where banking happens, placing seven branches inside Walmart Super Centers across Kansas. The strategy addresses a fundamental shift in customer behavior as mobile banking reduces traditional branch traffic. “We feel like you need to be where the people are,” Girard says. “If you’re in a bank branch today, in some of our communities, there’s not a lot of traffic in the lobby simply because customers are used to using their mobile phone to access their financial institution. So being in Walmart has given us a bank lobby with a lot of foot traffic on a daily basis.”

The Walmart locations prove particularly valuable in college towns. Branches in Lawrence and Manhattan serve students at the University of Kansas and Kansas State University, many of whom already bank with Central National. “A lot of those students moved from other Kansas towns and are already banking with us or their parents are,” Girard notes. “It’s a natural fit to continue that. Again, the ‘Money for Life’ philosophy.” The bank’s mobile app, rated 4.1 out of 5 stars by users, exceeds the national average of 3.8 for banking applications.

Interactive Teller Machines extend service hours at multiple locations, allowing customers to bank from 7:00 AM to 7:00 PM. Unlike standard ATMs, these machines connect customers via video to live tellers in Topeka who handle any transaction a person across a desk would perform. “That’s been helpful to offer extended hours of service,” Girard says. The bank’s most unconventional space sits in Wichita’s Old Town entertainment district, where comfortable couches replace teller lines and business owners discuss financing over beverages in a relaxed setting.

Supporting Every Financial Journey

The bank’s slogan highlights a comprehensive approach to customer relationships that spans decades rather than transactions. “When we take that to heart, we want to be there for every step of a person’s financial journey from when they’re a teenager opening their first checking account to when they’re buying a house or buying a business to retirement,” Girard explains. Central National introduced its second chance checking program roughly 20 years ago after recognizing a gap in the market for people rebuilding their financial lives.

“There are times when people get into a difficult situation in their life, maybe the economy changes, their business changes, they’re suddenly no longer able to open a checking account at most banks because they’ve had a credit issue in the past,” she says. “We’ve developed a second chance checking program to allow those folks to have an account with us, rebuild their credit and rebuild their financial footing, and then step into all of traditional bank products again.” The bank also offers trust services that encompass money management and estate planning.

Agricultural lending forms part of Central National’s foundation. Operating in farm communities throughout Kansas, the bank provides relationship-based lending. “We work with our farmers to help them with all aspects of their business, including strategic planning, succession planning, annual updates of their financial statements and things like that,” Girard notes. “We really want to be a true partner.” The bank hosts educational seminars where farmers learn about banking programs and federal resources, creating value beyond the loan itself.

Community Impact Beyond Banking

Central National’s influence extends through a deliberate strategy of keeping municipal deposits local. “When we take on those deposits that then gives us the capital to turn around and lend funds back into the community,” Girard explains. “It’s really an economic churn effect that’s very positive for local towns. If those municipal deposits are held in a bank that’s part of that local community, . The mega banks don’t operate that way, but we always have.”

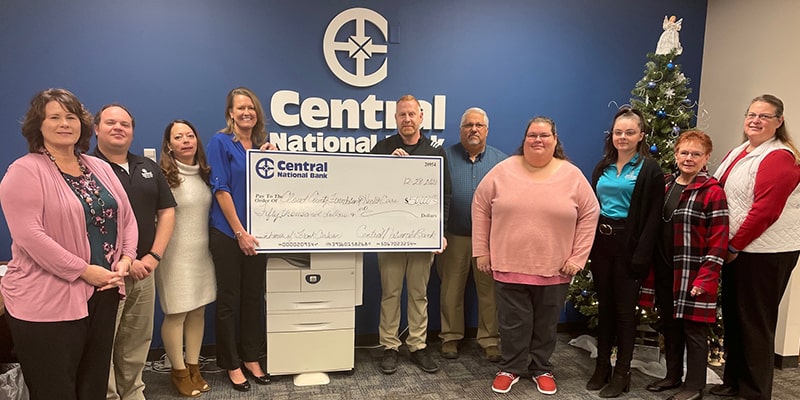

The Central Charities Foundation, established in Junction City over 30 years ago, has distributed millions of dollars to nonprofit organizations focused on education and quality of life improvements. Employees receive volunteer time off to serve their communities, and the bank maintains high participation goals for United Way campaigns. “We also have extensive volunteerism,” Girard says. “We offer our staff volunteer time off if they’re willing to go out and work in the community for a volunteer activity.”

The bank’s role as one of the financing partners for the Kansas Children’s Discovery Center is a high-profile example of community investment. The $11.6 million expansion project, which opened November 7, doubled the museum’s size from 15,000 to over 30,000 square feet. “We are very excited about that project, and that’s one that actually has statewide impact because the visitors that come to the Kansas Children’s Discovery Center are often from out of town,” Girard notes. The facility draws 120,000 annual visitors from all 50 states, creating educational opportunities while boosting Topeka’s tourism economy.

People, Technology, and Infrastructure

Central National faces the talent shortage affecting banks nationwide as baby boomers retire, creating knowledge gaps across the industry. “My challenge the last few years has been to find qualified talent to fill those gaps and talent that’s a good cultural fit for our bank,” Girard says. “Because I do consider my job to be the keeper of our culture, and it’s different than a lot of institutions. We operate very conservatively, and we really value prudent growth.”

The bank prioritizes promoting from within to maintain its distinctive approach. When recruiting externally proves necessary, Girard emphasizes the diversity of opportunities within community banking. “I think the most important thing that I try to convey to potential candidates who might not have considered the banking industry is all the diverse opportunities there are within a community bank,” she explains. “They don’t necessarily need to be in finance to be a very good community banker, but they do need to start, get some experience, learn to build relationships, and then I think most people find that it’s a fun job where you never know what you’re going to face day to day.”

Technology investments address cybersecurity threats that plague financial institutions. Nationwide, community bankers identify cybersecurity and data privacy as their top concern for 2025, with 28 percent citing it as the most pressing issue. Central National devotes substantial resources to staff training on phishing and social engineering, the most common breach vectors. “We spend so much, we devote significant resources to cybersecurity, and training is a big part of that,” Girard says. Recent implementations include digital investing capabilities, allowing customers to purchase stocks and ETFs through mobile banking, plus a new teller system designed to identify potential fraud in real time.

141 Years and Counting

As Central National celebrated its 141st anniversary in 2025, the bank’s priorities remain anchored in principles established over a century ago. “Our top priorities remain the same,” Girard says. “We’re very committed to our local communities, to our staff and their families, and we really want all of our employees and their kids and grandkids to grow up in great Kansas communities.” The bank’s headquarters in Junction City is located eight miles from Fort Riley, a military installation that generates $1.86 billion in direct economic impact annually and supports over 37,000 military personnel, families, and civilian employees.

Girard articulates a management philosophy that prioritizes stability over aggressive expansion. “We’re never going to be the fastest growing bank. We’re never going to be the most profitable bank, but we will manage our risks effectively and we’ll be in business 141 years later,” she explains. The bank recognizes its role as essential infrastructure in maintaining healthy rural economies. “We take our role very seriously to be an important player in keeping those communities, whether it’s a small town or a more urban area, vibrant,” Girard notes. “And without community banks, that can’t happen.”

AT A GLANCE

Who: Central National Bank

What: Family and employee owned community bank with $1.27 billion in assets, 35 branches across Kansas and Nebraska, serving 22+ communities with locally empowered leadership and comprehensive financial services including agricultural lending, second chance banking, and digital investing

Where: Kansas, USA

Website: www.centralnational.com